What is Shopify Payments? How Does Shopify Payments Work?

Byte Blog • October 28, 2024

Learn all about Shopify Payments, an easy and reliable payment system that allows businesses to quickly accept credit cards and digital wallets, along with its benefits in our article!

With the increase in preference for e-commerce, facilitating the payment process for both store owners and customers has become crucial. Even though various alternatives facilitate the payment process, several of them come to the fore for specific reasons. Shopify, one of the most prominent e-commerce platforms, offers various options for payment processing depending on several factors. One of these payment processing options is Shopify Payments, which is exclusive to Shopify store owners.

What is Shopify Payments?

Shopify Payments is a payment service offered by Shopify to help businesses manage online transactions and receive payments. Specifically built to meet the needs of Shopify merchants with Stripe infrastructure, Shopify Payments is available in 150 countries.

Shopify Payments Features

Shopify Payments allows users to facilitate their selling processes through its various features. These features not only make the payment process easier but also safer. Here are some of the features Shopify Payments offers:

Two-factor authentication requires you to enter your password as well as another form of verification like your mobile device or a security key to maximize the security of your Shopify account.

The advanced fraud protection Shopify offers helps to detect and prevent fraudulent transactions in your store.

Shopify POS feature allows you to unify your online and offline transactions, making it easier for you to follow all your orders and transactions in one place.

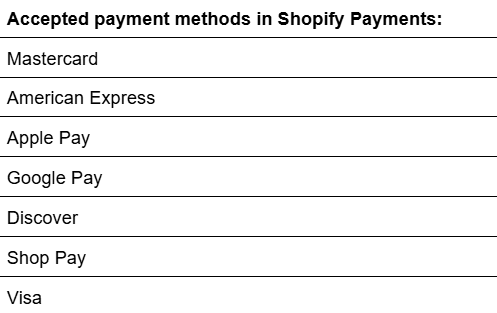

Shopify Payments allows you to sell in 133+ global currencies through various payment methods, helping you extend your market beyond borders.

How Does Shopify Payments Work?

As a payment processor and gateway, Shopify Payments transfers the payments you receive to the bank account you have registered on the Payment Providers page in your Shopify admin, whether it’s a checking account that meets the bank account requirements for your region or a Shopify Balance account.

How to Set Up Shopify Payments?

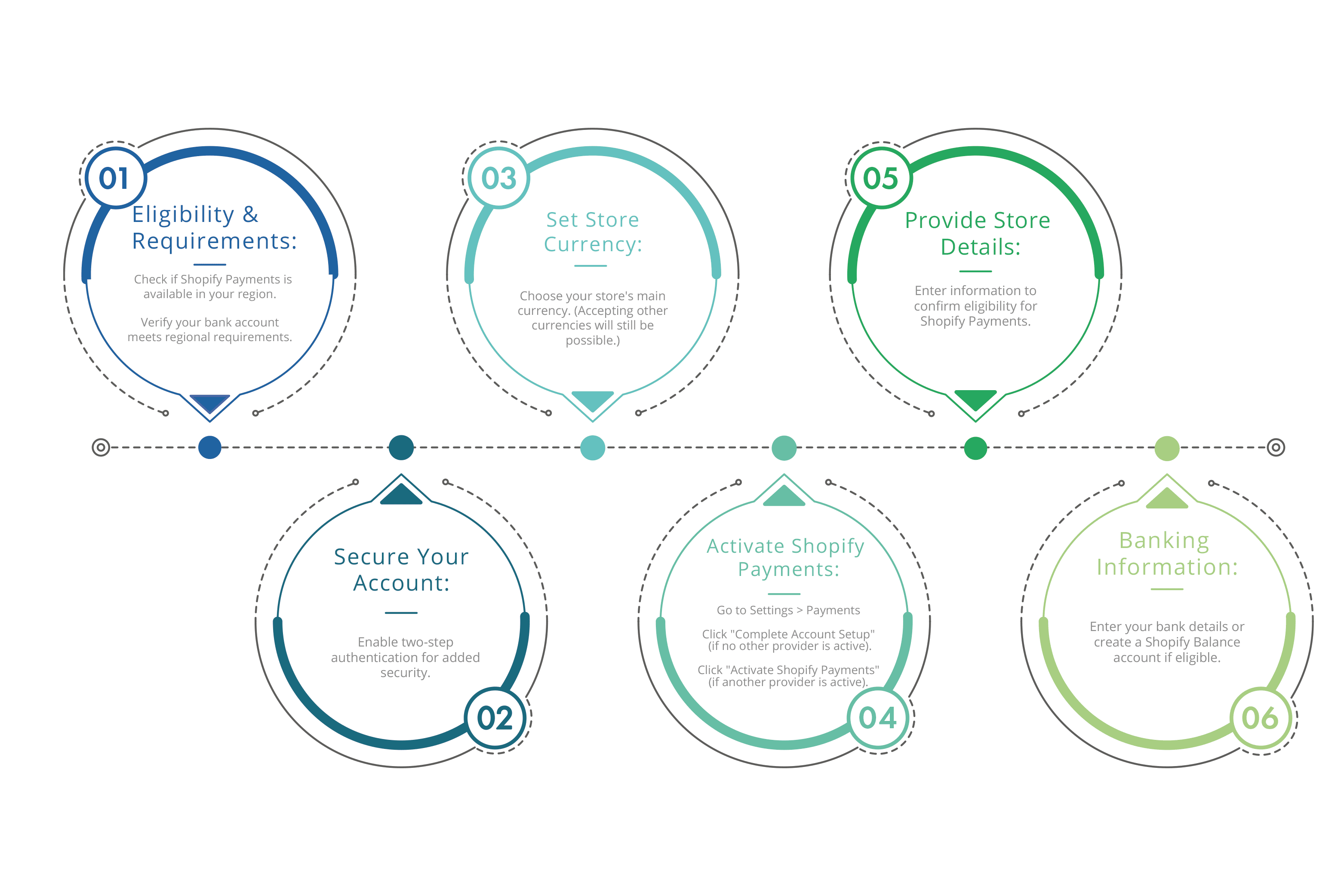

Before you set up Shopify Payments, you should check your eligibility and the bank account requirements specific to your region as they may vary.

Then, you should note that to use Shopify Payments, you must set up two-step authentication to secure your account and financial information.

After securing these steps, you should choose the currency of your store before you make your first sale even though you can receive payments in a different currency than your store currency.

Then, all you have to do is go to Settings > Payments, then activate it by clicking Complete Account Setup. However, if you have a different payment provider enabled, you will need to click Activate Shopify Payments to remove the other provider from your Shopify account.

Afterwards, you will be required to enter details about your Shopify store to ensure that you’re eligible to set up Shopify Payments and create a Shopify Balance account, or you will be prompted to enter your banking details.

Benefits of Shopify Payments

Easy Set Up

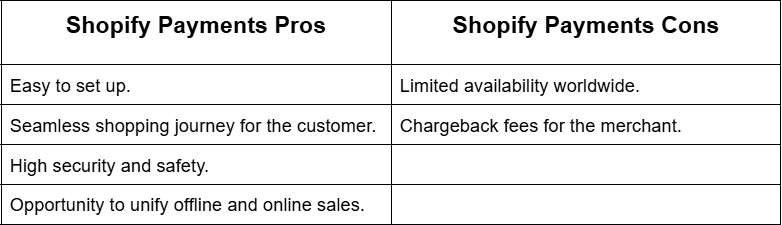

If you’re already using Shopify, setting up Shopify Payments is quite straightforward as it is an internal feature of Shopify. By following several simple steps, you can easily set up Shopify Payments and start selling. Easily setting up Shopify Payments, you will be free of the hassle of setting up third-party payment gateways

Better Customer Experience, Lower Cart Abandonment

As Shopify Payments provides a wide range of payment methods and a seamless checkout experience for your customers, you automatically improve customer experience and thus satisfaction. Plus, if you use and offer Shop Pay as a checkout option, which is a one-tap checkout option that is exclusive to Shopify Payments, you can improve your customers’ shopping experience further.

Safety and Security

The built-in tools in Shopify Payments that are used for fraud detection and protection help merchants secure their stores and payments. Tools like fraud analysis or proxy detection allow Shopify to create a safe and secure checkout process.

Unified Online and Offline Sales

The feature of Shopify Payments mentioned above, Shopify POS, allows you to take payments in your physical store too if you have one. Supporting the connection between your online and offline presence as a merchant, Shopify Payments can improve your marketing strategies by allowing your customers to have an option for their shopping preferences while helping you keep track of all your transactions from one platform.

Does Shopify Payments Have Any Downsides?

Even though Shopify Payments is a facilitating payment gateway for merchants using Shopify, it has some disadvantages. Primarily, the fact that it is exclusive to Shopify is seen as a downside by some merchants.

Limited Availability

Another downside to Shopify Payments is that it isn’t available in all countries. If you’re located in a region where it’s not supported, you won’t be able to use Shopify Payments. In this case, you’ll be subjected to transaction fees, which vary based on the platform’s different plans.

Chargeback Fees

As a store owner, you will inevitably face chargebacks. Whatever payment processor you might use, almost all of them have a chargeback fee. Shopify Payments’ chargeback fee of $15 is in line with alternatives such as Stripe; however, Shopify Payments’ resolution time might be longer than the other which is a setback.

Alternatives to Shopify Payments

Suppose you are a merchant of a region where Shopify Payments is not available. In that case, there are some alternatives you can prefer, like Stripe which is the main infrastructure of Shopify Payments. Stripe and PayPal, being two of the most preferred payment processors, can be considered alternatives to Shopify Payments.

What is Stripe?

Stripe, a platform that powers Shopify Payments is a payment processor and an acquirer. As the availability of Shopify Payments may differ depending on the region, Stripe is used as an alternative payment gateway when Shopify Payments is not available. While Shopify Payments does not require additional fees for Shopify Plus accounts, Stripe has additional fees depending on the region.

Stripe vs PayPal

Like Stripe, PayPal is one of Shopify’s default payment providers. The main difference between PayPal and Stripe is that in some aspects, PayPal is better suited for small businesses as it is easier to use and set up without professional knowledge. On the other hand, Stripe offers more room for customization for your checkout flow, which might require advanced technical knowledge.

The Bottomline: Shopify Payments and Seamless Transactions

Shopify Payments, a payment provider exclusive to Shopify store owners offers seamless payment processing experiences for merchants. Easy to set up and highly secure, Shopify Payments offers merchants a quite convenient way to process their transactions with little downsides. With the limited availability of Shopify Payments across the globe, its alternatives might be preferred; however, an increase in the prevalence of Shopify Payments is also expected.